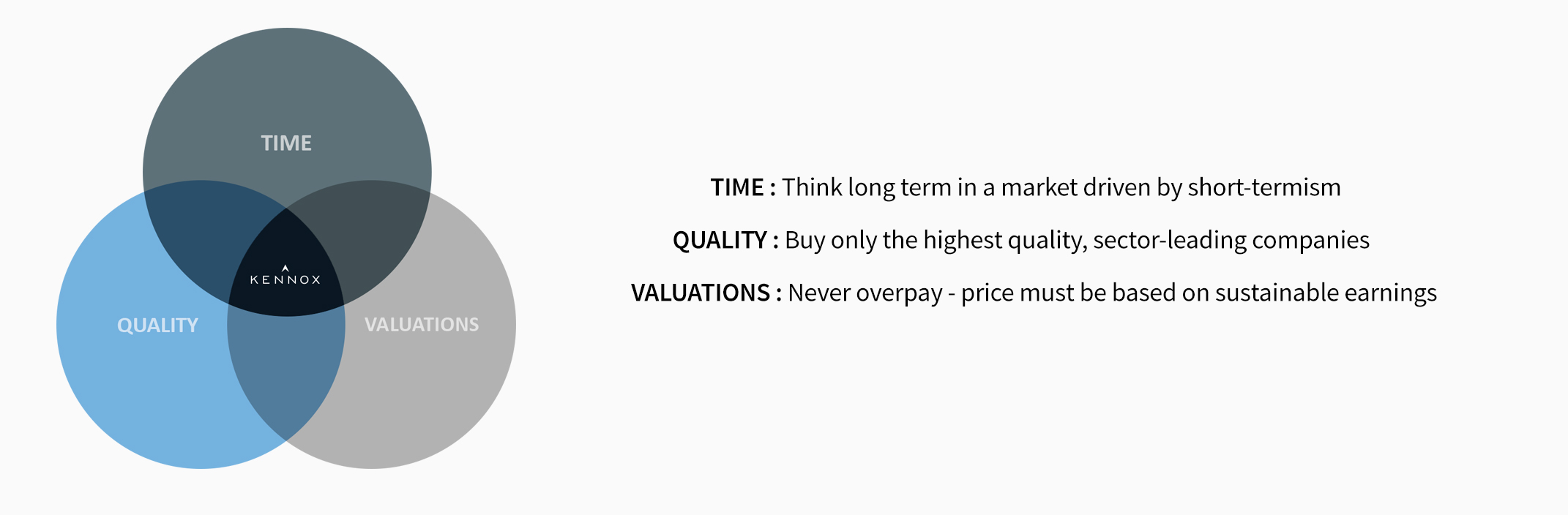

Our Kennox Value philosophy drives everything we do – from the structure of our business, through our processes to the highly differentiated portfolio we produce – and has remained unchanged since portfolio inception.

We buy only the highest quality companies and only when they are available on excellent valuations. We achieve this by thinking only in the long term.

Time Our independent structure gives us the freedom to take a long-term view in a market dominated by short-termism. We look to take advantage of opportunities generated by market over-reaction to a company’s uncertain, often unattractive, shorter-term prospects. We buy exceptional companies when they are unloved and have the patience to hold for the longer term, allowing short-term headwinds to turn to tailwinds.

Quality Our focus is always on the underlying health of a company, rather than its short-term growth prospects. All our stocks have the hallmarks of quality which minimise the risks inherent in equity investing:

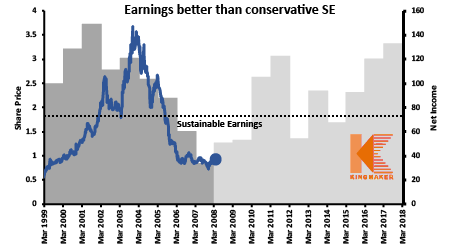

Valuations We believe valuations are a primary driver of any investment decision, not just a secondary factor. We insist on getting our companies at excellent prices. For us, this means looking through a company’s shorter-term performance and prospects and instead assessing its Sustainable Earnings - the earnings that we believe a company can conservatively sustain over a 5-10 year period.

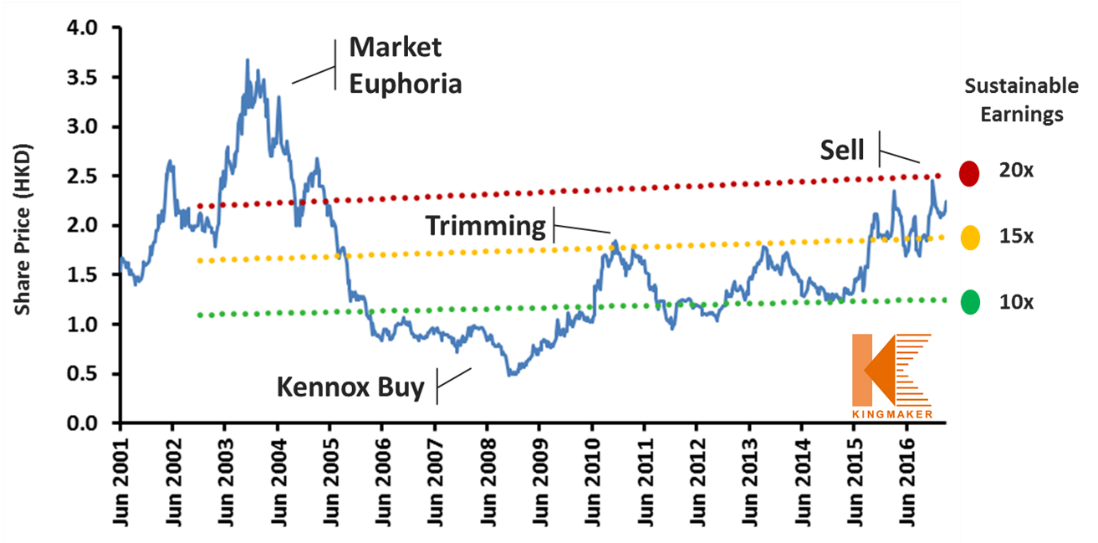

We will pay a price that reflects a conservative multiple of these earnings: up to 12x Sustainable Earnings. On this multiple, we can achieve excellent long-term returns without the need to make significant growth assumptions. This low multiple also provides the opportunity for exciting upside on possible re-rating.

Our focus on valuations continues throughout the period we hold each stock. Conscious that risks increase as the share price rises, we look to trim a holding as it goes through 15x Sustainable Earnings and will be exiting the position when the share price reaches our risk threshold of 20x Sustainable Earnings.

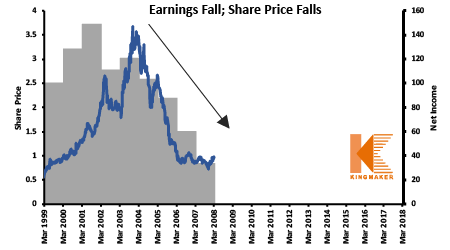

We look at hundreds of companies experiencing falling earnings (as Kingmaker was when we bought in 2008) but invest only in a select few (2-3 per year) where we can gain conviction on the long-term sustainability of the company. Kingmaker was one such company: a small ($100m), HK listed shoe manufacturer.

The opportunity: In 2004, Kingmaker walked away from a large American client as US anti-dumping laws eroded margins. This was a rational management decision, aimed at optimising long-term performance over short-term revenue streams. With falling revenue and earnings, the market reacted and the share price fell over 70%.

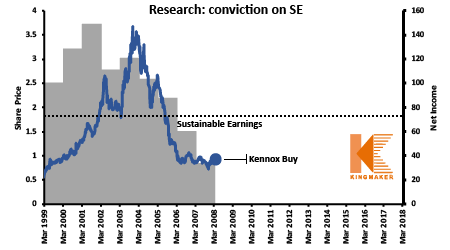

Detailed Research – finding conviction in Sustainable Earnings: We took the time to assess whether Kingmaker had Sustainable Earnings by challenging the consensus, looking at all the fundamentals driving and surrounding the company. We found that the market had overlooked a number of key points in Kingmaker’s business, including:

Having established the quality of the company, we used undemanding margins and revenue assumptions (both significantly discounted from peaks) to set a conservative level for Sustainable Earnings: $75m through the cycle. This equated to a valuation of 8x SE – well below our maximum entry level of 12x SE.

Able to achieve conviction in our Sustainable Earnings, we initiated our first buy in March 2008.

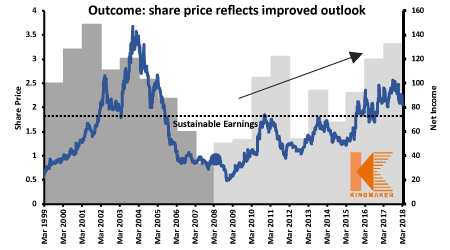

The outcome: As long-term investors, patience is key. Confident in our view of Sustainable Earnings, we were willing to wait for Kingmaker to make the necessary adjustments to its business, anticipating a recovery of earnings and a subsequent reflection in the share price. With time earnings improved, rising significantly above our Sustainable Earnings assessment, and the share price responded accordingly.

As is typical of a Kennox stock, we saw price fluctuations on short-term earnings movements during the course of our holding period. These provided us with opportunities to add (at prices below 10x SE), trim (at 15x SE) and exit when the price reached our upper valuations threshold of 20x SE.

Our return on Kingmaker was +570%.