June 2024

We very much enjoyed Fred Hickey’s recent interview with Adam Taggard on Thoughtful Money (you can watch the interview on YouTube here). He runs through reasons that equity prices have run so far, focusing on some of the “AI companies” attracting a great deal of market attention. With mega-caps being amongst the biggest beneficiaries of that surge in equity prices, passives are also faring well for the time being. Perhaps surprisingly, we are not against passive index-tracking funds at Kennox, though you need to be a bit more wary at the end of a long bull market. Rather, we think they have a place in many investors’ portfolio alongside carefully selected active funds. You just need to make sure that the active funds are genuinely active.

In our latest quarterly report, we cover some of the stocks driving performance in the Kennox Fund and how differentiated these are to the wider market.

We are also pleased to attach the latest fund factsheet.

May 2024

We attended the London Value Investor Conference in May again this year. There was a renewed sense of optimism across the value investing community: even after several years of much improved performance for the style, the opportunity set remains broad, especially away from the US. This certainly echoes our own experiences in the markets. Specific ideas on the day included copper, Japan on the back of the seismic changes in corporate cultures there, and of course the UK – the market that everyone has recently loved to hate. It was an outstanding event, as ever, and we thoroughly recommend any interested investor coming along next year.

Elsewhere, John Gapper’s article in the FT (here) does an excellent job of expressing concern about recent boycotts, such as the Edinburgh Book Festival and Baillie Gifford. The festival felt under pressure due to Baillie Gifford’s holdings in tech companies (that have tangential links with Israel) on one side and energy companies on the other. “The boycott’s biggest problem is not its shallow logic or its elements of hypocrisy: it is that the campaign causes harm in the guise of doing good.” That this muddled thinking distorts financial markets is one thing (which at least can be exploited by a common-sense investor), but the damage that it is causing to the arts, and to wider society, is unforgivable.

Finally, we are also pleased to attach the latest fund factsheet.

April 2024

As we find ourselves mid-way through first quarter reporting season, it’s pleasing to see good results coupled with un-demanding valuations being recognised for several of our companies.

Yue Yuen (a pan-Asian shoe manufacturer) is a good example. It hasn’t been an easy hold as Covid disrupted both supply chain logistics and Chinese retail operations, but having jumped 30% on the fourth quarter results announcement in March (when the market could no longer ignore the rapid recovery of their operations and profits), the share price jumped another 30% in April on the back of a positive profit alert: this quarter’s profit will be approximately double last year’s. Even after the share price rises, the stock trades on 10x historic earnings – frugal for a company with growing earnings and a 6.5% covered dividend yield.

Speaking of Asia, Charles spoke with the legendary fund manager Angus Tulloch at the Library of Mistakes. It is well worth listening to Angus’ reflections on his career and experiences, a fund manager who worked for half a century through booms and busts, in an exciting area and time for the markets. You can watch the video here.

We are also pleased to attach the latest fund factsheet.

March 2024

We think there’s a beauty in owning a range of investments that are genuinely different from each other, not ones all pointed in the same direction.

We discuss several examples in this quarter’s commentary – including one that is especially overlooked but just now hitting the sweet spot of revenue growth with expanding margins.

You can read more in the quarterly report.

We are also pleased to attach the latest fund factsheet.

February 2024

Currys (the UK and Nordics electronics and appliance retailer) has attracted a number of takeover bids in February (as mentioned in the FT here). As we discussed in our last quarterly, there has been a marked increase of interest in our companies of late. This should not be a surprise, as our portfolio is full of very frugally valued businesses, but it’s pleasing that others are becoming aware of the opportunity. That said, we don’t want to see our companies taken out too cheaply, and we were more than happy to see Currys rejecting the bids as Sky New Zealand did in November.

As usual, please find our factsheet here.

January 2024

Our two South Korean holdings are up about 20% this week, yet they still trade at 0.4x & 0.5x book value. This sits alongside strong earnings potential, net cash on the balance sheet and attractive dividend payouts.

We feel there is plenty more to go – and hopefully this type of sensible contagion continues to catch on.

For a local’s take on it, please see this link: Expectations rise for Korea's value-up program for underperforming stocks - The Korea Times

As usual, please find the monthly here.

December 2023

The conclusion of the quarterly commentary reads as follows: “We enter 2024 full of optimism despite, rather than because of, the global macro-economic backdrop. The portfolio looks well positioned after a relatively active 2023, valuations remain incredibly attractive (the portfolio yield remains close to all-time highs and new stocks added during the year all trade at single digit PEs), there is a rising interest in the types of stocks that Kennox loves (as shown by increased corporate activity) and we are comforted by continuing to hold very little that has significant levels of debt on the balance sheet.”

You can read more, including on specific stocks, in the quarterly report.

November 2023

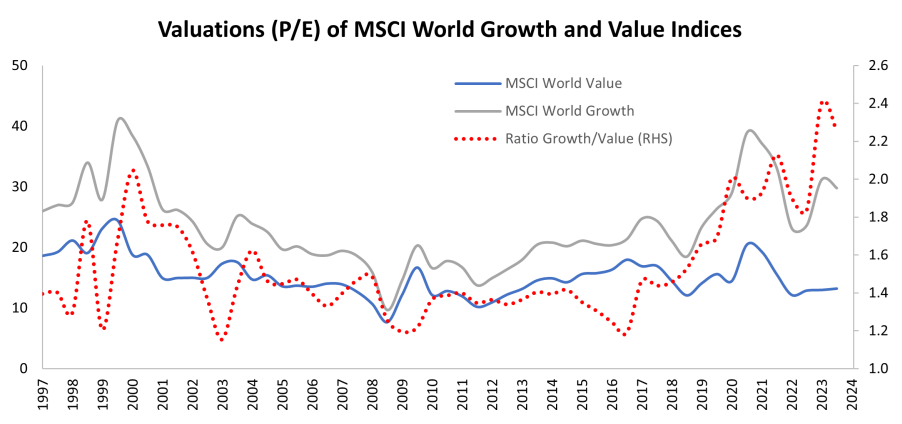

It’s hard to ignore how lopsided markets have become, favouring growth (especially US & tech) over everything else. As an example, look at the red dotted line in the graph below, the difference between value stocks looking inexpensive versus their history (the blue line) and growth stocks looking expensive versus theirs (the grey line).

The last time this ratio peaked, during the dot.com boom and at a level significantly below where we sit today, value outperformed growth for 7 years straight (2000 to 2006)…

At any time, investors should ensure they have at least a few eggs in the “not growth” basket. Perhaps given the current valuation discrepancy, they should have more than a few.

* Data from Bloomberg showing Price to Earnings ratio (excluding negative values) of MSCI World Growth Index and MSCI World Value Index

October 2023

Are you keeping an eye on the long bond market? Even if you’re a generalist or an equity investor, perhaps you should be.

The US 10-year bond has been weak, recently breaching the headline 5% yield threshold. This matters for two reasons. First, it’s the market indicating that a higher cost of capital across the board is not as “transitory” as many had hoped. Second, over the last decade of cheap money, many investors have flocked into increasingly crowded trades and many market participants have taken on ample lashings of leverage. Bond price weakness piles pressure on both – and any uncontrolled rush to the exit would be extremely painful.

Hopefully, the long bond market issues unwind quickly and smoothly. But sometimes it pays to be prudent, not hopeful.

September 2023

In our latest quarterly report, we note that several of our holdings are seeing a broadening dislocation between burgeoning operations and stagnant share prices – managements are genuinely scratching their heads as to why the market is not marking up their lowly share prices alongside improving outlooks. This dislocation is a powerful indicator of future potential, with Sky New Zealand being an excellent example.

Have a look at the quarterly if you’d like to read more.

August 2023

We’ve noticed lately that the dividend yield on the Fund has been creeping up and now sits at all-time high levels (3.8% for the Class A and 3.6% for the Class I, net of all fees and notably higher than the gross yield of 2.0% on the MSCI World). This rise comes on the back of increasing dividends from our holding companies matched with the attractive valuations we are finding out in the market.

We bring it up as we find this one metric to be especially helpful, both as shareholders and as managers – it’s a good indicator that we are finding attractive valuations, and it shows that the companies that we invest in are willing to share and are looking out for their shareholders’ interests. It also balances shorter-term returns in the form of cash dividends with longer-term capital growth.

July 2023

Should investors buy government bonds at present?

Although outside our daily focus (the Kennox Fund only invests in global equities), we appreciate the importance of bonds:

· They represent a huge portion of global savings

· They moonlight as the “risk free rate” (although former SVB management might argue with you here)

· They remain essential to the smooth functioning of governments worldwide

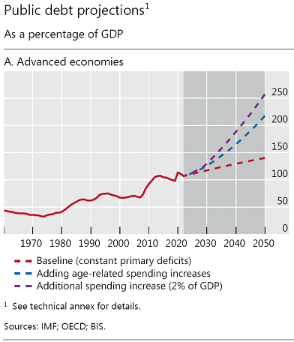

Kennox has long been wary of government bonds and our unease is only increasingly. Global governments (bonds’ ultimate backers) are getting more and more exuberant in trying to absolve the private sector of risk. This drives spending and the plentiful supply of bonds ever higher. Our wariness was reinforced by a few graphs in the excellent BIS Annual Economic Report, such as this one:

Annual Economic Report 2023 (bis.org)

That this ballooning in debt levels has been increasingly absorbed by central banks only adds to the worry – the Fed owns about a quarter of all their government debt, the BOE about 35%, the ECB about 40% and the BoJ an astounding 50% (as shown on the graph on page 52 of the report).

Owning a government bond is aligning yourself and your wealth with this sort of spendthrift behaviour, questionable pass-the-parcel strategy, and monetary wishful thinking. In the short term, this might well not matter. But in the long term, this is a significant headwind, if not an outright trainwreck. We urge caution while merrily sticking to what we know. Back to our day jobs...

PS – we would recommend reading the “Longer-Term Backdrop” section in the introduction of the BIS report (on page “ix”). It’s only a page long but an excellent summary aligned to our view of how we got into this mess.

June 2023

Opportunities abound for our style of investing. In the Q2 2023 Quarterly Report, we talk through three new stocks added to the Fund in 2023: Youngone Holdings, LG Corp and ODP Corp.

These are differentiated opportunities trading at exceptional valuations. This is inherently attractive in a narrow market that has only become more consensus, as described in the Quarterly:

“Concentration at the top of most markets has increased markedly. Apple, now worth over $3tn and more than the entirety of the Russell 2000, constitutes 7.7% of the S&P 500 making it the largest single stock in the history of the benchmark… The dominance of a few stocks by performance is even more startling than by weight. In the first half of 2023, the largest seven stocks (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta) produced 77% of returns. The bottom 460 stocks produced negative returns in aggregate.”

May 2023

We attended the London Value Investor Conference last month, the tenth iteration of this conference and every year we’ve taken something away. This year, two points really struck us.

Firstly, there are a range of opportunities that are very, very inexpensive. There are companies out there that have fallen far out of the market’s favour – examples include: selected situations in the US especially smaller companies (where the Russell 2000 index of smaller companies is worth less than Apple by itself); separately each of Hong Kong and South Korea came across as extraordinarily inexpensive but with strong investment cases; and even commodities as an asset class (certainly relative to the wider US stock market). Presenters highlighted a variety of companies. Some are trading on a fraction of book value (as low as 0.2x), others on earnings multiples less than 5x, or with stacks of cash on the balance sheet, or paying dividend yields over 10%, or companies embarking on buy backs that represent a substantial proportion of their entire enterprise value. Extraordinary. As always, each situation needs to be analysed for its own merits and nuances, but the gist of these narratives aligned with what we are seeing in our own holdings.

Secondly, most investors are still looking the other way and have little or no exposure to these inexpensive areas, having done so well out of growth and momentum in the past decade. For short term speculators, this doesn’t matter as flows and momentum will dictate prices. But over the longer term the stock market aligns to where attractive opportunities lie.

Our impression of the market is that it is stretched to quite extreme levels, with the fashionable/consensus/growth so much preferred over the unfashionable/non-consensus/value. At these levels, even investors who have a strong bias against value should have some exposure – say 10-20% of their portfolio – just in case they’re wrong. Those with more of an inclination to value should scale up from there, comforted by the magnitude of the opportunity.

April 2023

The difficulties in the US banking system rumble on, with First Republic succumbing earlier this week and PacWest teetering even as we write this. The most sensible commentary we’ve seen on the situation is from Richard Bookstaber in the FT, who points out the weakness of a rules-based approach, or “oversight based on unnumerable detailed rules”. He notes: “we don’t fail because of mismeasurement at the second decimal point or a poorly drafted subsection. We fail because our regulatory approach misses material risks wholesale.” As our financial and regulatory systems have barrelled a long way down this overly prescriptive and flawed route, and following the period of perhaps the loosest money in history, sadly we feel this might rumble on for a while yet.

Experiencing risks unseen in decades (such as the return of inflation) or never before (the climate change transition, the hangover from the period of the easiest money in history), investors will have to be more imaginative in managing risk and opportunities, thinking beyond merely what has happened in recent times.

March 2023

“Opportunities arise when a wide gap opens between reality and appearance…. Current markets offer many opportunities, coming from over- and under-investment in various industries in the global economy, from the market’s crowding and herding, from the authorities’ monetary actions of the last few decades. This is what allows Kennox to be fundamentally optimistic about the prospects for the Fund, in the face of, or even because of, the challenges facing investors at present.”

Our risk focused quality value portfolio has a track record of strong performance in difficult markets – if you’d like to discuss our strategy, please do not hesitate to be in touch.

February 2023

The Fund was flat (up 0.1%) in February 2023.

Investors wrestle with uncertainty in the global markets at present: what does Quantitative Tightening mean and will central bankers and politicians hold their nerve in the face of continuing adversity? Will inflation go up, down or sideways, in which order and for how long (interest rates likewise)? Will there be economic hard, soft or no landings? What is the impact of the ongoing war in Ukraine, the trade tensions with China (it remains the world’s largest exporter of goods, by the way), the energy transition alongside climate change? And so on.

Facing these unknowable quandaries, investors should be wary of paying up, especially for a rosy consensus. For instance, the US, on average, is expensive and priced to deliver sub-par returns – well laid out recently in this Hussman Funds article. It’s not that the US can’t perform, but it is fighting an uphill battle.

Rather, Kennox has the portfolio strongly tilted towards the inexpensive and unloved, trading at a significant discount to US and global markets. This simple but powerful advantage over the market significantly improve investors’ chances of producing positive returns even in tough markets. In times of headwinds and uncertainty, this can be invaluable.

January 2023

Following a strong year in 2022 (up 13%), the Fund was up 1.6% in January 2023.

The investment landscape changed markedly late in 2021, and the key question on every investor’s mind since then should be whether it will flip smoothly back again, or whether this new landscape will prevail. We noted the following in Ruchir Sharma’s article of the 29th January 2023 in the Financial Times: “Combined stimulus in the US, the EU, Japan and the UK, including government spending and central bank asset purchases, rose from 1 per cent of gross domestic product in the recessions of 1980 and 1990 to 3 per cent in 2001, 12 per cent in 2008 and a staggering 35 per cent in 2020.”

With government spending appearing to be one way traffic, a quick and painless switch back to the old investment landscape looks less and less likely. Please see the Portfolio Positioning section of the factsheet as to why Kennox feels this suits our style well.