As you might remember from our last speech in 2014, we’re devout pessimists. But it’s getting hard, given the distortions we are seeing in the markets, not to become optimistic. We think that the outlook for value is very good.

Before discussing distortions, I will give a brief overview of Kennox value. After all, the interpretations of value amongst practitioners is varied, from Buffett to Ben Graham, and as seen by the range of presentations at this conference over the years. What does value investing mean to Kennox? Risk is at the forefront of our minds, so, to offset this, we buy quality. “You own Nestle?”, some may wonder. No. Our focus on valuation means we don’t pay more than 12x Sustainable Earnings. That knocks out Nestle. How do you find great companies at 12x Sustainable Earnings? Time – you have to think longer term than the market, you have to be patient, and you likely have to buy these companies at a time when they are facing headwinds – certainly not when everyone loves them.

The three fundamentals for us are Quality, Valuations and Time. However, in the last eight years of rising stock prices and unprecedented monetary policy and quantitative easing, the market’s application of these key investment fundamentals has become subtly, but significantly, distorted.

Whilst they may not be immediately obvious, these distortions are highly dangerous. However, if you become aware of them, they can be used to your advantage.

In what follows, I’m going to discuss our view of these distortions, what an investor can do about it and maybe even take advantage of them. Finally, I will look at one of our current portfolio stocks this perspective.

Fundamental 1 – Buy Quality

Most would say the quality of the business they buy is critical – very few would say they are buying garbage. However, here’s the distortion: the market’s definition of quality has narrowed – narrowed so much that quality now means only near-term growth. The other hallmarks of quality, as we see them – sector leadership, conservative management, strong and defensive balance sheets – no longer seem to count.

This narrowing creates a great opportunity to buy companies that don’t fit this limited and flawed definition of “quality”, but remain exceptional, sustainable business franchises. For Kennox, quality is fundamentally about sustainability.

Fundamental 2 – Valuations Drive Returns

We all know that valuations are important but expressions like GARP (growth at a reasonable price) better reflect common thinking today. Valuations certainly no longer feel like the primary driver of equity returns. It has become no more than a secondary consideration – maybe just an inconvenience?

If you don’t believe me, just look at the valuations that stocks are commanding, the only way this can make sense is if investors are focusing on growth and not valuations. For those of you who, like us, think the cyclically adjusted PER is a useful number, the S&P number is now on 29x – it’s only been more expensive twice in history – 1929 and in 2000.

When this applies across the entire market, the basics of economics and economic history will tell you it’s risky.

Fundamental 3 – Timing matters

Well yes, but not in the way that most people think. Most people now think the time to buy companies is when the outlook is great and it’s all smooth sailing. That’s the distortion – the danger is that you always pay a full price for this level of comfort.

Currently, “buy low, sell high” doesn’t feature, as it feels as if all investors are chasing the same thing. “Buy high, hope to sell higher” feels closer to what what’s driven markets recently.

But it’s also the opportunity. Look at how hard companies are being punished when they go through tougher periods.

As has always been the case, the best opportunities are when quality companies go through (temporary) headwinds. That’s the only time you get these companies at great prices.

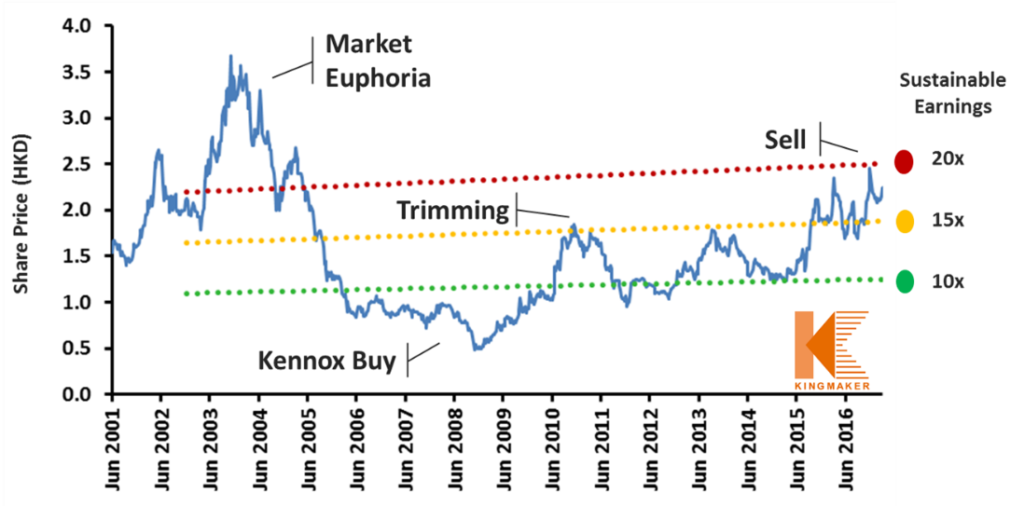

Let’s look at some of these distortions with a quick concrete example, over an investment cycle, i.e. a stock we bought and sold – in this case, the company is Kingmaker. It makes shoes, but for today, we’re not going to talk about what Kingmaker does, we’re going to look at market psychology.

Before we start, let me explain something about our process. Our analysis of a company is always based on finding the long term Sustainable Earnings of a business (often quite different to the short term stated earnings). This takes time and effort, this is where you really dig, and more often than not, we still don’t get conviction and we drop it. For the few where we do get conviction, we plot valuation lines of 10-, 15-, and 20x Sustainable Earnings.

So how did the market distortions impact Kingmaker?

Phase 1: the company was growing fast, and the market fell in love – valuations no longer mattered, and it traded at heady valuations, well north of 20x Sustainable Earnings.

Phase 2: Kingmaker lost a contract, earnings stopped growing, heaven forbid, it even shrank. This was no longer deemed to be a “quality” company, and, through 2005-2007, the share price reacted accordingly.

That’s when we did a lot of work on it and had to decide whether we could gain conviction as to the long term Sustainable Earnings of the company. In other words, were those headwinds temporary or permanent? In this case, we felt they were temporary.

Phase 3: Timing mattered.

This is how to take advantage of these distortions – picking up quality at very attractive prices when a company is facing headwinds. And be patient while these headwinds turn to tailwinds. We didn’t buy at the bottom and we had to endure lower prices, but we topped up and it was worth it. – Kingmaker recovered from its temporary problems, the market re-rates it and Kingmaker moves from 7x to over 20x Sustaniable Earnings. At this point we exit our position.

The Kingmaker example shows how rewarding the style can be. It’s not comfortable to buy when there are headwinds – this takes nerve and it’s not always easy. But it’s also why value investing works.

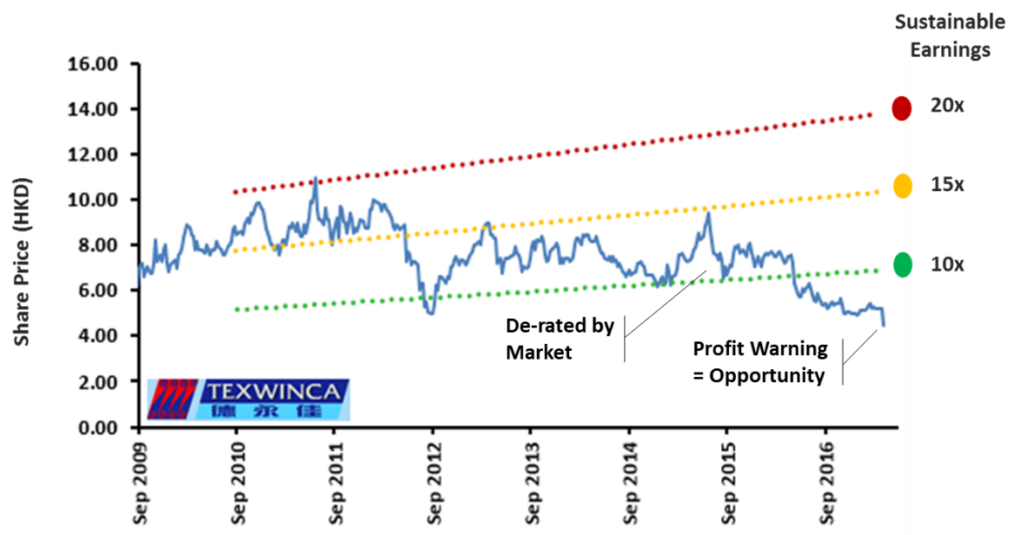

We’re excited because we see a lot of Kingmaker in Texwinca. As we were considering which stock to highlight, Texwinca had a profit warning – a classic headwind that allows a great price. This is value investing. It might be noted that this is a conviction position for us – it’s the fourth largest stock in the portfolio.

Texwinca is a $1bn company, listed in Hong Kong, a manufacturer of specialty and hi-tech fabrics including anti-UV, wicking, stretch, on behalf of major blue-chip retailers. Its clients include names such as Uniqlo, Tommy Hilfiger, Abercrombie & Fitch, Kohl’s, Gap. Texwinca also has a non-core retail business, called Baleno, offering casual, affordable clothing.

Fashions come and go, but retailers will still need fabrics to manufacture clothes and this company is are very good at what it does.

Let’s start by looking at quality – remember that quality for us is sustainability and the long-term health of a company and therefore it has to have certain hallmarks: market leader, conservative management, solid balance sheet. Why do we think Texwinca will be around, and thrive, long into the future?

It is a market leader: One of three main competitors in the area of providing high tech fabrics to leading international brands. Texwinca has developed the systems and skills to deliver to the tightest schedules, a key consideration for retailers. It’s commonly known as the Zara effect: shortening the time from design studio to shop floor.

A further consideration for retailers and their suppliers is in the area of ESG. They have to be cleaner than clean regarding environmental and social issues. Are factories polluting? Do they employ underage or mistreated workers? Conforming to these standards, and, being able to prove/document that it does, raises the competitive bar enormously. This has been a game changer over the last 20 years. This severely limits competition. And, an additional ESG bonus, it is good for the environment and social welfare. Texwinca is very good on all fronts.

Next, does the company have competent and conservative management? We all know how important management is. But for us at Kennox, we want sustainability, so we want safe hands, looking after what the company already has; not excitement, not heady growth. The family owns about 50% and has been making good business decisions for decades. We think the franchise has the best chance to be well looked after for the longer term.

Lastly, it must have a solid balance sheet for a rainy day. Texwinca has no debt and has been storing away cash reserves since 2009, and it’s squirreled away everywhere you look on the balance sheet. That cash is worth 50% of the market cap. That’s a lot of rainy days.

Quality is about sustainability, and Texwinca has all the hallmarks.

Quality doesn’t work for us if we’re paying through the nose for it – we make sure we’re getting this quality at very attractive prices.

On Texwinca, we did our research and digging to get a view of Sustainable Earnings and here are our Sustainable Earnings lines again. You can see that the company has been getting de-rated since 2015, as Texwinca, and its profits, face headwinds and the market goes looking elsewhere for growth and excitement.

Which means we can see Texwinca with an enterprise value of just 6x our view of Sustainable Earnings. It’s also got a great history of generating cashflow and paying it out in dividends – historic dividend yield, excluding specials, is 10%. EV/EBITDA between 3 and 4x.

There is a significant margin of safety in these valuations.

Lastly, time. Texwinca is facing current headwinds (that gives us an opportunity), that we think are likely to turn into tailwinds in our investment period

Its core fabrics business has been soft, and its cyclical retail business has fallen to break even.

Due to Texwinca’s quality, we think the softness in the core fabrics business is temporary. And we think it will fix Baleno or exit it, only at a reasonable price, and either way, this will be beneficial to the share price.

The time to buy is when you’re getting a bargain and that time is now.

The underlying company changes but rarely as much as the market thinks. It’s rarely so good as the good times portray, nor as dire as it appears in the bad times.

Like Kingmaker, we think Texwinca is a stock overlooked by a market with all its inherent biases. If you can look past the current headwinds, and have the courage of your convictions, this is where you can take advantage, this is where there are juicy opportunities.

The last eight years have been fascinating. Undoubtedly, the next eight years will be very different – it is even possible that bull market conditions might not prevail. What to do?

We propose to you that Quality, Valuations and Time taken together form a sensible, logical, risk aware investment strategy. Applied consistently, investors can find real bargains. Importantly, it also has the advantage of being different to what most of the market is trying to do, and therefore offers real diversification to most portfolios.

As we said at the beginning, we’re struggling not to become optimistic. The market’s perspective has been distorted, but that’s our advantage: the greater the distortion, the greater the opportunity.

Delivered to the London Value Conference 2017 (amended)